What is a PF Form 19?

A PF form 19 is used to withdraw a sum of money given to the employee at retirement through the Employees’ Provident Fund (EPF). The EPF is a government-backed scheme where employees of all sectors portion out a part of their salary monthly, so it can be retrieved later when either the employee is unfit for work or decides to retire.

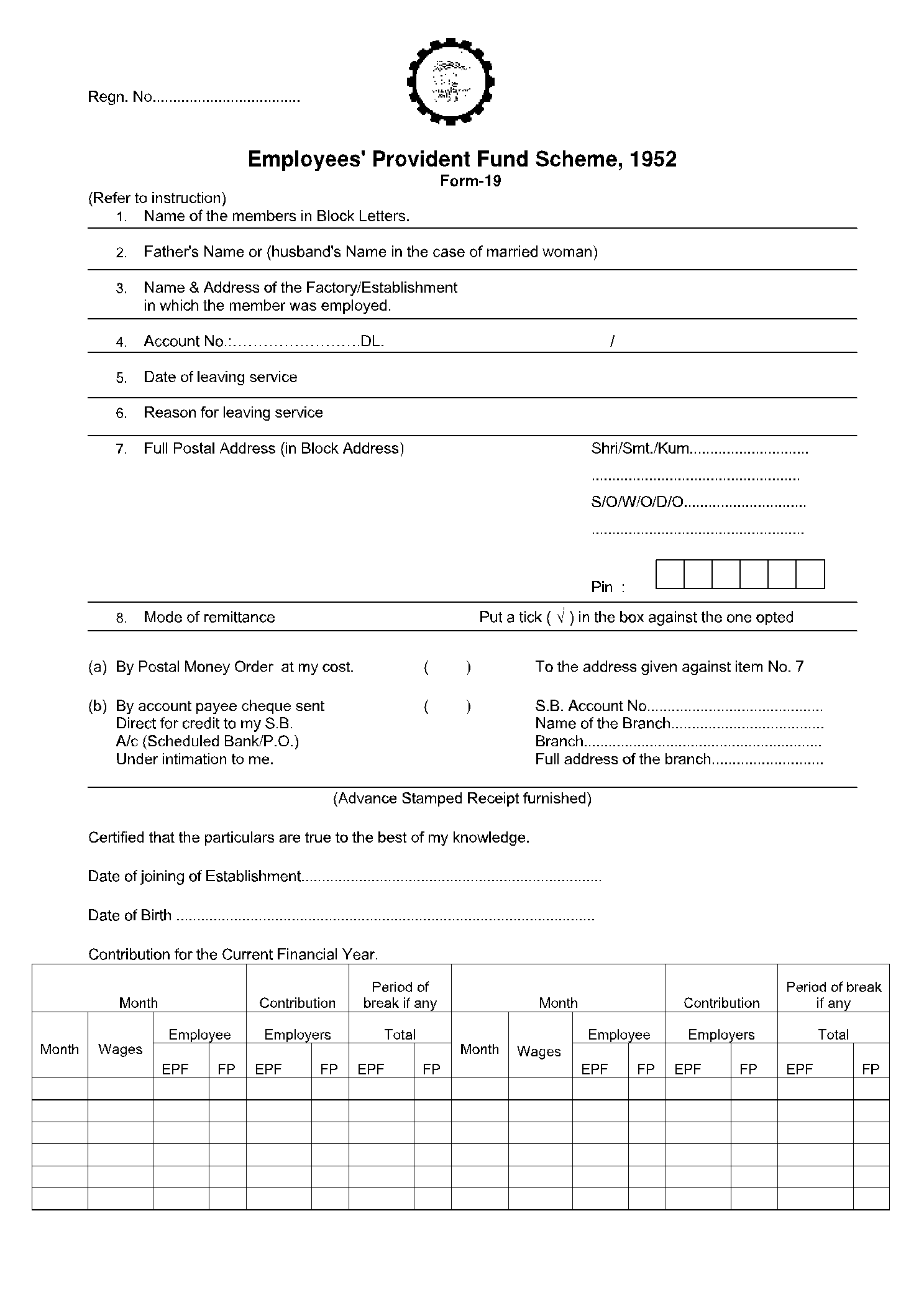

Data Needed on a PF Form 19

PF form 19 is a government form, and so it comes with several fields to collect various information about the applicant. The form is also divided into parts to make it easier to understand for a wider audience.

- Personal Information

The first part of the form asks for details like names and addresses. Some of the fields will have the text ‘BLOCK LETTERS’ in front of them, which means that every letter in that field should be in uppercase and have a noticeable amount of space between them. These are the fields one has to fill in the personal information section:

- Name, father’s/husband’s name, and date of birth

- Name and address of the factory/establishment

- PF account number and Universal Account Number (UAN)

- Date of leaving the service and reason for leaving

- Permanent Account Number (PAN)

- Full postal address

- Mode of Payment

The second part of the form asks for the preferred payment method of the applicant. The offered options are account payee cheque, money order, or electronic mode of payment. Those who chose a cheque as a payment option will also need an additional part of the form, including the advance stamped receipt.

- Contribution to the Current Final Year

As the name suggests, this section will address all the contributions made in the current final year. The data is divided into months, and all of it should be filled in a premade table on the form.

- Advance Stamped Receipt

This last section of the form should only be filled by those who chose cheque as a payment option. Details relevant to the mentioned cheque are asked here.

- Thumb Impressions

The member will also need to sign the form using inked thumb impressions.

How to Completely Fill a PF Form 19?

A PF form 19 can be filled digitally or by printing the form and submitting it to the relevant institution. Filling the form online comes with its own set of benefits, such as data that is auto-filled, decreasing the chance of causing mistakes by a considerable margin. To fill the form online, follow the steps below:

Step 1 - Visiting the portal

Head over to the EPF member portal and enter the UAN and password here. In some cases, a captcha might also be required to proceed further. If you have trouble with the captcha, it can always be reloaded to ask a different question.

Step 2 - Selecting the desired form

Navigate through the page and locate the ‘Online Services’ tab. Then select the ‘Claim Form - Claim Form – 31, 19, 10C & 10D’ from the menu.

Step 3 - Verify the personal details

A new form will be opened right in front of you with all the required information already entered. Verify that the details are accurate and then proceed forward. These are the details that will be mentioned in the form.

- Name

- Father/husband name

- Date of birth

- Contact number

- KYC details

- Service detail

Step 4 - Verify bank details

Next, your bank account details will be shown to you, and the form will ask for the last 4 digits of your account. Enter those 4 digits and double-check them as it’s imperative not to cause mistakes here. After everything has been double-checked and verified, press the ‘Verify button.’

Once your bank details are verified, enter the Date of Ending, EPF, and EPS account. The form will also ask for a reason regarding your departure from the organization.

Step 5 - Certificate of Undertaking

A ‘Certificate of Undertaking’ will be presented to you when you have entered the required details. Proceed with ‘Yes.’

Next, choose the ‘Only PF Withdrawal (Form 19)’ in the ‘I want to apply for’ field.

Step 6 - Aadhaar OTP

Enter the required entails here and then click on ‘Get Aadhaar OTP.’ You will then receive an OTP at the registered mobile number. Enter this OTP at the required field and submit the application.

What Are the Typical Uses of the PF Form 19?

Whenever someone retires, an amount is returned to them that comes from EPF funds. For the withdrawal of the mentioned sum, one must use a PF form 19. Additionally, the form can also be used to get a PF non-refundable advance and receive pension benefits. However, unlike fund withdrawal and pension benefits, a PF non-refundable advance may only be applied when the person is still in service. Even then, there are a set of conditions to be met.

Who Can Fill Out a PF Form 19?

Any employee possessing a provident fund account can fill a PF form 19 and receive its benefits. The benefits include features such as receiving the PF sum at the time of retirement or in a condition where the concerned person is unfit to continue with the work.

However, for an employee to use this form at withdrawal, any time they spend on vacation should be without employment. Moreover, as mentioned earlier, the employee can also use the form to get a PF non-refundable development subject to certain terms and conditions and can only be called for when the person is still working.

Additional PF Form 19 Resources (External Resources)

To further information about the PF Form 19, head over to the official government site of the form, where they offer additional resources for the applicants to use and offer a link to fill the form itself.

https://epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form19_instructions_Eng.pdf